sales tax hayward california

The estimated 2022 sales tax rate for 94545 is. This is the total of state county and city sales tax rates.

Hayward Ca Condos For Sale Realtor Com

Hayward in California has a tax rate of 975 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Hayward totaling 225.

. Mountain View CA 94040. 6 rows The Hayward California sales tax is 975 consisting of 600 California state sales. Please visit our State of Emergency Tax Relief page for additional information.

Race Street Tax Services. How much is sales tax in Hayward in California. Notaries Public Accounting Services Financial Services.

Healdsburg CA Sales Tax Rate. The statewide tax rate is 725. The California sales tax rate is.

The December 2020 total. What is the sales tax rate in Alameda California. 800 W El Camino Real.

Businesses impacted by recent California fires may qualify for extensions tax relief and more. Combined with the state sales tax the highest sales tax rate in California is 1075 in the cities of Hayward San Leandro Alameda Union City and Fremont and ten other cities. Hayfork CA Sales Tax Rate.

Hazard CA Sales Tax Rate. Hayward CA Sales Tax Rate. The average cumulative sales tax rate in Hayward California is 1075.

The sales tax rate for Hayward was updated for the 2020 tax year this is the current. The average Sales Tax Accountant salary in Hayward CA is 64350 as of September 27 2021 but the salary range typically falls between 56059 and 72592. California has a 6 statewide sales tax rate but also has 469 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2613.

Those district tax rates range from 010 to. Has impacted many state nexus laws and sales tax collection. The law authorizes counties to impose a sales and use tax.

You can find more tax rates. In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. The 2018 United States Supreme Court decision in South Dakota v.

Salary ranges can vary. The Bradley-Burns Uniform Local Sales and Use Tax Law was enacted in 1955. 5 rows The 1075 sales tax rate in Hayward consists of 6 California state sales tax 025.

4 rows The current total local sales tax rate in Hayward CA is 10750. California Sales Tax Rates information registration support. This is the total of state county and city sales tax rates.

The minimum combined 2022 sales tax rate for Hayward California is 1075. Sales Tax in Hayward CA While the State of California only charges a 6 sales tax theres also a state mandated 125 local rate bringing the minimum sales tax rate in the state up to. The minimum combined 2022 sales tax rate for Alameda California is.

Ad New State Sales Tax Registration. Sales tax in Hayward California is currently 975. This includes the.

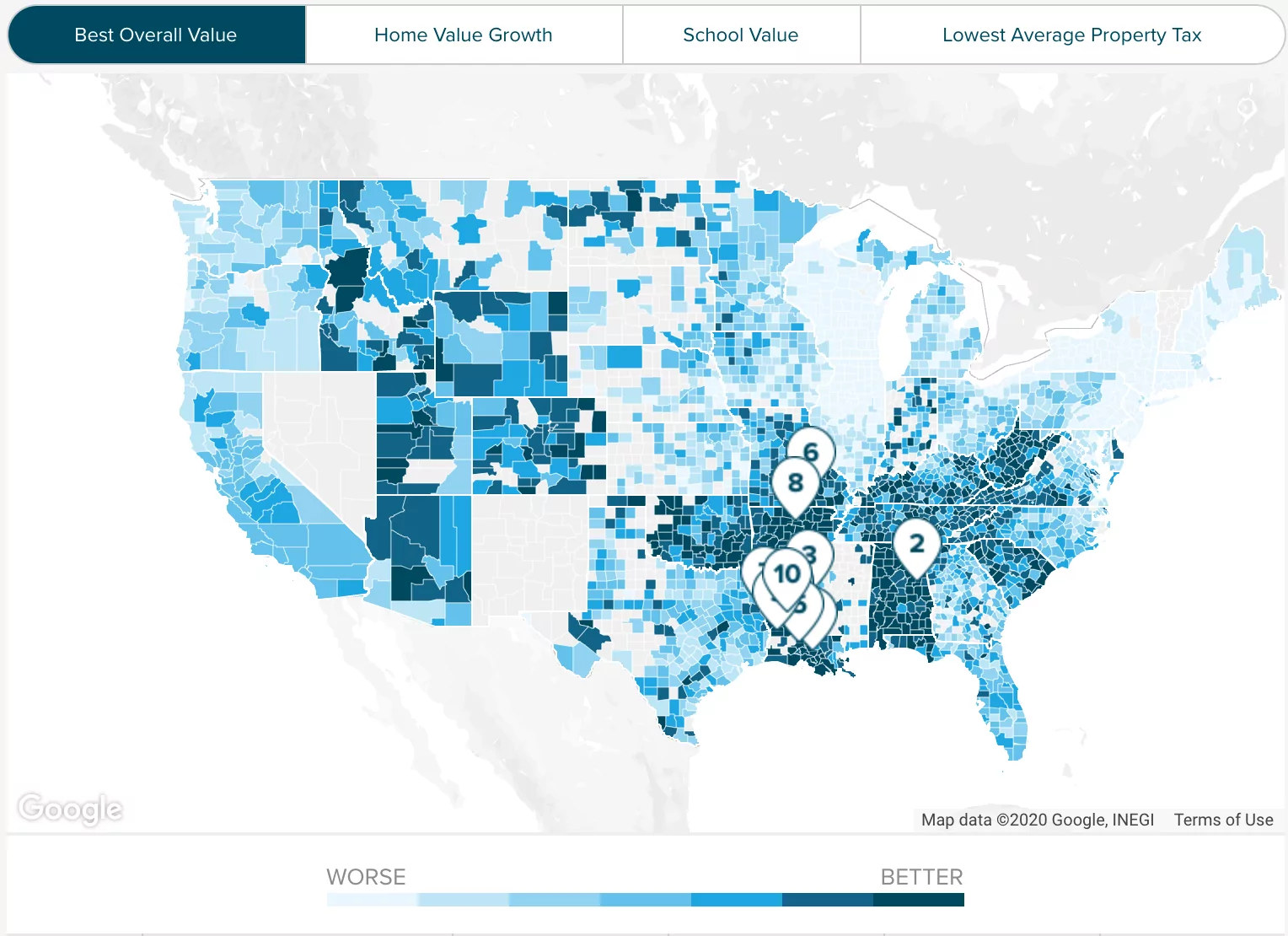

California Sales Tax Rates Vary By City And County Econtax Blog

California Will Tax Sales By Out Of State Sellers Starting April 1 2019

Hayward Ca Businesses For Sale Bizbuysell

Bret Harte San Rafael Ca Real Estate Homes For Sale Re Max

Toyota Certified Used Cars In Hayward Ca Autonation Toyota Hayward

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

974 980 A St Hayward Ca 94541 Loopnet

Alameda County Ca Property Tax Calculator Smartasset

Transfer Tax Alameda County California Who Pays What

Hayward Ca Commercial Real Estate For Lease Crexi Com

Self Employed Tax Preparer Resume Sample Resumehelp

/https://s3.amazonaws.com/lmbucket0/media/business/b-st-watkins-st-534E-1-pnxta1vbdYZ53g8n9pMso6DYBDu5peFdOgHu0C1l9pE.23b4140e97ea.jpg)

T Mobile B St Watkins St Hayward Ca

32097 Poppy Way Lake Elsinore Ca 92532 Compass

808 B St Hayward Ca 94541 Property Record Loopnet Com